Lucky reversal MT4 indicator displays buy sell aroow signals in the main chart. It can be used with any forex trading systems / strategies for additional confirmation of trading entries or exits.

- DESCRIPTION

- INDICATOR SETTINGS

- SIMILAR INDICATORS (14)

- REVIEWS (109)

Forex trend reversals happen all the time. As long as there are trends, there will always be reversals. Many trend and trend reversal trading tools and strategies depend on this simple concept. It’s now only a matter of how a trader can use the right tools to catch the reversals and trade the trends. The Lucky reversal indicator is one of the many reversal trading indicators out there. But it has some unique features that make it different from other forex trend reversal indicators.

What Is The Lucky Reversal Indicator

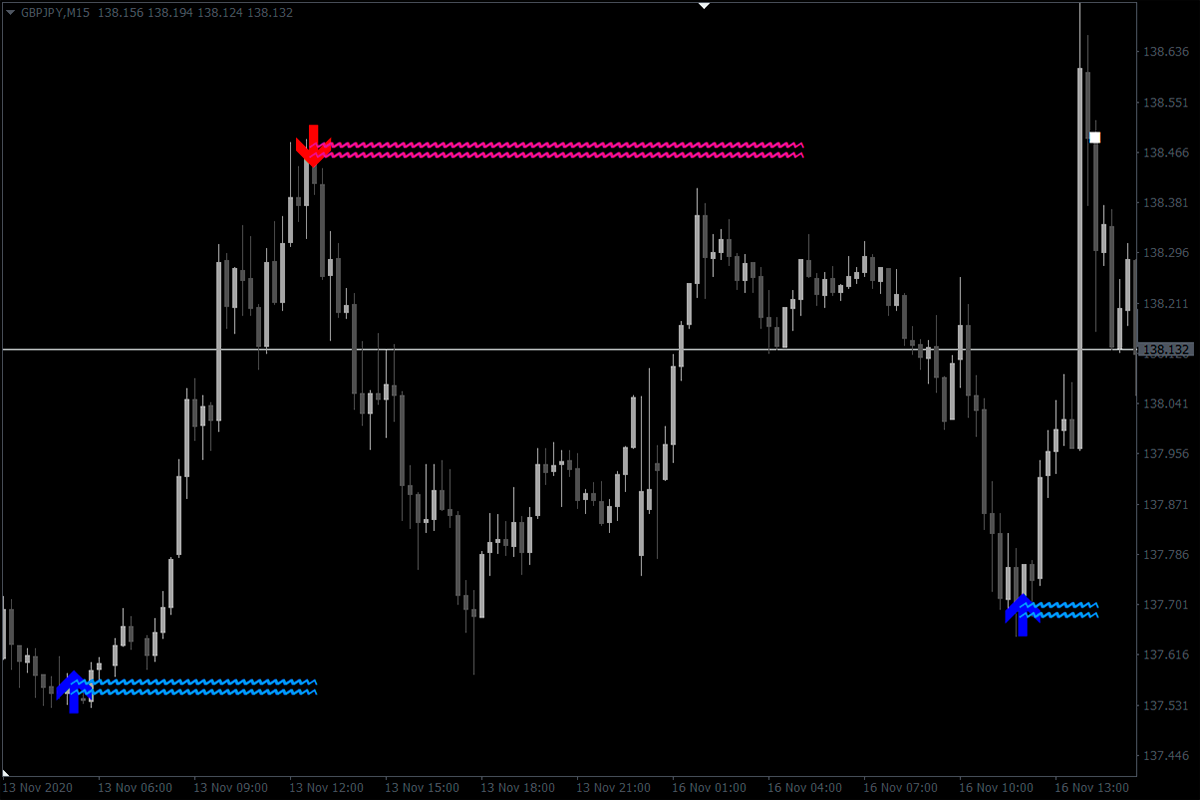

The Lucky reversal indicator does what its name implies: it tells when the trend has turned from an uptrend to a downtrend, or from a downtrend to an uptrend. It gives its signals in the form of blue and red arrows, each followed by wavy horizontal lines. The blue arrow marks the beginning of an uptrend while the red arrow signifies a market reversal to the downtrend.

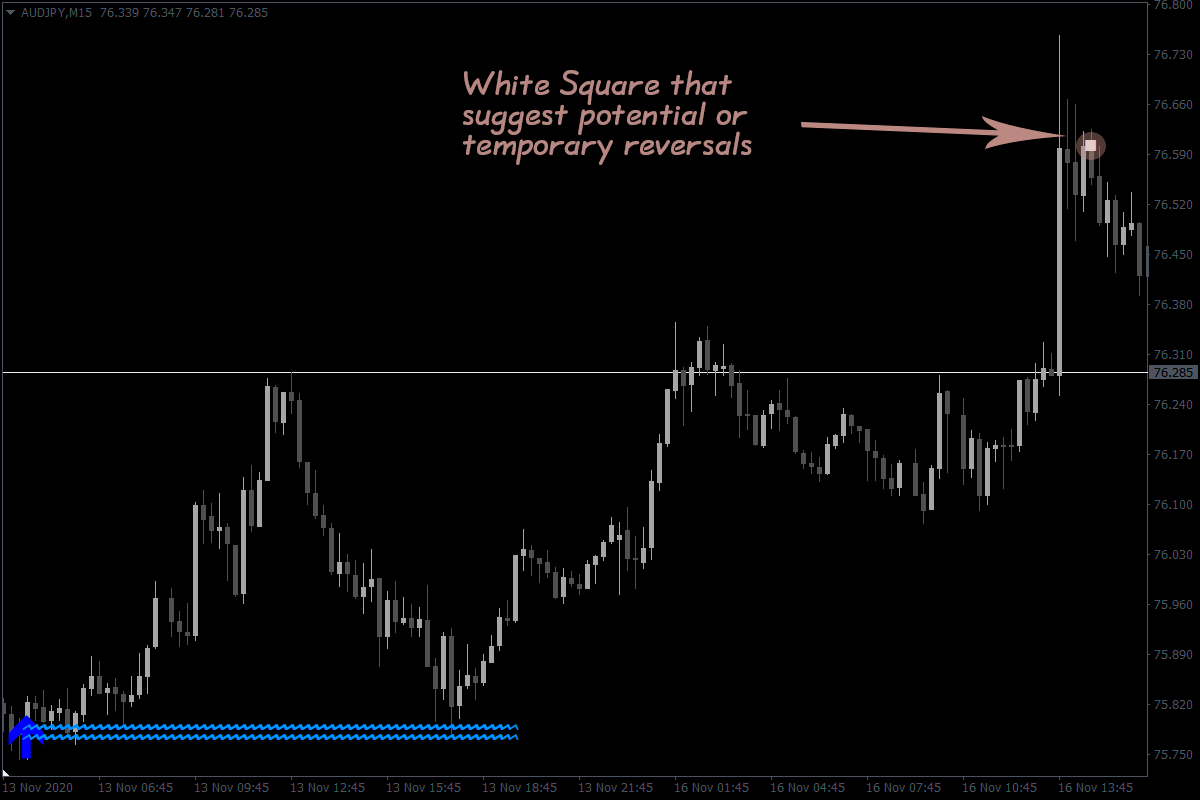

There is another feature of the Lucky reversal indicator that is not obvious at a first glance. This feature is the white square that appears when the indicator is suggesting a temporary or potential reversal.

The major flaw of the Lucky indicator

The Lucky reversal indicator is unlike many trend reversal indicators out there. The reason is that it is a lagging indicator, so a trader can hardly trade reversal breakouts with it.

Many traders have had their shares of frustration from trying to use the indicator to catch the beginning of reversals, and you can’t blame them for trying. If you backtest the indicator, you will find that the bullish and bearish signals are right at the lowest or topmost pivot points of major trend reversals. See an example in the image below. You’ll notice that price seems to reverse as soon as the arrow appears.

On testing the indicator on a live market, however, you will find out that the bullish or bearish signals only appear after the market has completed a reversal. The reversal arrow appears on the chart only when the reversal has been confirmed. This shows that the Lucky reversal indicator lags.

The major strength of the Lucky indicator

The major weakness of the Lucky indicator is its strength. Because it lags, you can hardly catch reversals with it, but you can use it to confirm trades in the emerging trend. For instance, you can trade the uptrend that emerges after the market has completed its reversal from the downtrend to the uptrend.

The Lucky Reversal Indicator Trading Strategies

The best way to trade using the Lucky reversal indicator is to include it in a trading system where you can use it in confluence with other trading tools. Other trading tools in the strategy could be indicators or market structures (supports and resistances, candlestick patterns, chart patterns, etc).

To help you understand how to combine the Lucky indicator with other indicators, we will use the indicator with the Moving Average indicator to form the first trading strategy.

1. Combining Indicator With The Moving Average Indicator

Pull up the Lucky indicator, and two moving averages on your chart. Leave one moving average as it is, but change the period of the other moving average to 20. Change the color as well so you can tell it apart from the other moving average. The default moving average will be our fast moving average, while the 20 MA is our slow MA.

The next thing is to wait for the Lucky indicator to give you a buy or sell signal. Remember, that this indicator lags, so you are not looking to trade the buy or sell signal of the indicator. Instead, we want to trade entry opportunities in the direction of the trend that the Lucky reversal indicator confirms. This is why we have those two moving averages.

When our trend reversal indicator gives an uptrend signal, you only buy when the fast MA crosses over the slow moving average to the upside. Do not sell until the Lucky reversal indicator changes from the blue arrow to the red arrow. And when our reversal indicator gives a downtrend signal, you only sell when the fast MA indicator crosses the slow-moving indicator to the downside.

That is how you combine the Lucky reversal indicator with other indicators. You don’t have to use the moving average periods we used here for your own strategy. You don’t even have to use moving averages. All you need to do is to find a trend trading indicator and combine it with the trend reversal indicator as we have done.

Having said that, there is still another way to trade the signals of the Lucky indicator. And this brings us to the second trading strategy.

2. Trading The Lucky Reversal Indicator Signals

Many times, the Lucky indicator displays the white square where there is a likely to be a reversal. From this point, price keeps moving but the white square remains at its position. When a trend reversal is confirmed, the white square changes to an uptrend or downtrend signal. At the close of the candle where the white square changes to a buy or sell signal, make the appropriate trade.

For instance, make a buy trade when the Lucky indicator confirms an uptrend, and make a sell trade when the indicator confirms a downtrend.

Trade Management

For each of the trading strategies up there, the best way to set your take profits is to set price targets. Don’t wait till any of the indicators give an opposing signal before you exit the trade.

And when you want to set your stop losses, don’t forget to not risk more than you can afford to lose. A rule of thumb is to not risk over 2% of your capital on a trade. With that at the back of your mind, you may then use any method you’re familiar with to set your stop loss.

The good thing about the Lucky indicator is that once it draws its wavy lines, price rarely crosses over to the other side. You may use this to set your stop losses too, but it might not always give you palatable risk to rewards ratios.

Who Is The Lucky Reversal Indicator Best For?

The Lucky reversal indicator is best for intermediate and professional forex traders.

Beginner forex traders who understand what lagging forex indicators are and know how to trade them may use the indicator as well, but with caution. To get the best out of this indicator, they may first need to know how to identify forex trend reversals.

Also, the trend reversal indicator is best for trend and trend reversal traders.

12345